Topic: Income tax

Section 206AB and 206CCA: Higher TDS and TCS

Section 206AB [For TDS] and 206CCA [For TCS] have been newly inserted by Finance Act, 2021. These have been inserted for imposing higher TDS/TCS rates on non-filers of tax returns aka a specified person.Effective DateSection 206AB and 206CCA is applicable from 1st July 2021.Applicab...

Joint Bank Account Tax Rules for Interest on Saving, Fixed Deposit

Getting a joint bank account is common financial planning among us.In this type of bank account, the account holders are named as:Primary account holder, and Secondary account holderWhile opening the bank account, the account holders can choose any of the prescribed modes of operation...

Section 80TTA Deduction : Interest on Saving A/c [AY 2020-21]

Introduction 80TTA is an income tax deductions provided to Individuals and HUF for interest on savings account up to Rs.10,000/- only. Non Residents are also eligible for this deduction. [Available in FY 2019-20]Saving accounts held in following institutes are covered for the deduction:Bank ...

LTA Leave Travel Allowance Rules-Exemption-Calculation[FY 2019-20]

Leave Travel Allowance (LTA) is an actual expense based allowance provided to an employee for travelling within India during the leave period.It is also referred to as Leave Travel Concession (LTC).This allowance can be in form of:Reimbursement of Travel Expenses, Concession in Ticket...

Income Tax on Intraday Share Trading Profit or loss [FY 2019-20]

Involvement in share market leads to two type of income:Business Income Capital GainA person can have both the above incomes and these are taxable with few variations.Income will be termed as a capital gain when an investor takes the delivery of shares. Depending on the period of holding C...

Tax on Gratuity, Exemption Limit and Calculation [AY 2018-19]

Gratuity refers to the money received by an employee from his employer at the time of:Retirement Resignation Termination DeathGratuity is payable only to persons who have been employed for 5 years or more with the employer. In case of death, disease or accident, the time limit of 5 years...

Tax on Leave Encashment: Calculation, Exemption [AY 2021-22]

Employees are allowed to take leave for a fixed number of days throughout a year. These leaves are paid i.e an employee’s salary will not be deducted if he takes leave within the employer’s policy. Depending on the employer’s policy towards leave, in case of not using of the fixed leave, an em...

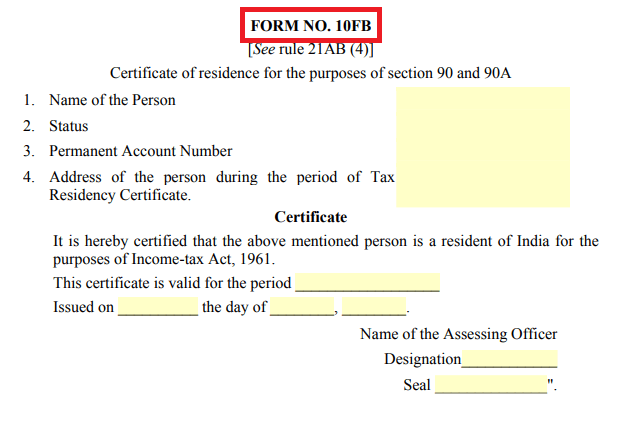

How to Get India’s Tax Resident Certificate in Form 10FB

To avoid foreign tax deduction, every Indian citizen is required to submit tax resident certificate to their foreign tax authorities. [IRS for the USA] Indian Citizenship is irrelevant for this certificate. A foreign national can also obtain this provided he fulfills the prescribed conditions. In th...

Income Tax on Rent Free Accommodation and Calculation

Apart from the fixed salary, employers also provide various perks in form of either good, service or money to their employees such as a car, maid, a house without rent etc.These perks are known as perquisites and it is completely taxable in the hands of the employees as Salary Income.Rent free a...

Online e-File ITR 1: Salary Income with Form 16 [AY 2018-19]

![Online e-File ITR 1: Salary Income with Form 16 [AY 2018-19]](https://www.meteorio.com/wp-content/uploads/2018/07/11-B1.png)

In this article, we will cover the step by step process to file an online tax return for salaries and pensioner taxpayers in ITR 1 (Sahaj). Who can File ITR 1 Sahaj ITR 1 Sahaj is for a resident individual havingSalary Income Pension income [Considered as salary] Income from one house ...

Pravin

Pravin