Are u self-employed and lives in a rented house?

If yes,

then this article will help you to save tax on your rent payment as provided under section 80GG.

This deduction is also available to an employee who doesn’t get HRA.

Who is eligible for deduction u/s 80GG?

Only an individual can claim deduction under section 80GG. He can be a self-employed person.

Alternatively, he can be an employee who does not get HRA from the employer.

What are the conditions for getting deduction u/s 80GG?

Following condition must be satisfied to claim deduction under section 80GG :

A. The taxpayer must be an individual or HUF.

B. He should pay rent for residential accommodation for himself and family and does not get any allowance from the employer.

C. He, his spouse, minor child (including a minor step-child and minor adopted child) or the HUF of which the taxpayer is a member should not own any residential accommodation at the place where the taxpayer resides, perform the duties of his office or employment or carries on his business or profession.

D. If own any house property other the place noted above, then that property should be shown as either let out or deemed to be let out. i.e not self-occupied.

Example: Mr. Mishra is having a flat in Banaras which is let-out and he lives in Mumbai in a rented flat. He can claim the deduction of section 80GG with respect rent paid for flat in Mumbai.

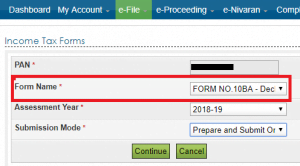

E. Online Furnish declaration in form 10BA

What is the limit of 80GG Deduction?

For the Assessment year 2019-20 [FY 2018-19] , the maximum deduction u/s 80GG is Rs.60,000 (Rs.5,000 per month)

How is the HRA exemption calculated?

HRA = Actual rent less 10% of total income (before deduction u/s 80GG)

However, HRA should not exceed the lower of the following :

- 5000 per month

- 25% of “total income”

Example

Gross total income of Mohan, an IT professional, is Rs. 6,50,000/- [professional income/salary: Rs. 6,00,000/- , Interest on bank deposit: Rs. 50,000/-]. He pays Rs. 9,500/- as mediclaim insurance premium deductible under section 80D and Rs. 80,000/- as house rent. He deposit Rs. 24,000/- in public provident fund. Compute his taxable income for the assessment year 2019-20.

Solution

| Professional income/salary | 600000 | |||||

| Interest on bank deposit | 50000 | |||||

| Total income | 650000 | |||||

| Less- deduction under section 80CCC to 80U | ||||||

| Under section 80C | 24000 | |||||

| Under section 80D | 9500 | |||||

| Under section 80GG (computed below) | 15000 | |||||

| Net Income | 601500 | |||||

Calculation

- HRA under 80GG = 80000 – 10% of 650000 = Rs.15,000/-

However, HRA should not exceed lower of the following:

- Rs.60000/- (5000*12)

- 1,62,500/- [ 25% of 650000 ]

About Author

Pravin Giri

(@Pravin) Twitter | FacebookPravin is a Qualified Chartered Accountant [CA]. Gives opinions on Income tax, GST, and finance.Find him on Twitter @Pravinkumargiri

Popular topicsIncome tax Income from other sources Deduction Salary Personal Finance Senior citizen House Property Capital Gain TDS GST Companies Act GST FAQ TCS