Tax audit is a systematic and independent examination of books of accounts to ascertain a correct picture of tax liability and to provide disclosures as per taxation law.

Under Income Tax, only specified persons are required to have a tax audit. [Under section 44AB]

In this article, we will cover every aspect of tax audit as per income tax act.

Limit / Criteria

For a financial year, a person is required to have a tax audit if he is:

| Sl no | Particular | Condition |

| 1 | Carrying Business and NOT using section 44AD | Total sales or turnover exceeds Rs.1 crore |

| 2 | Carrying Business and using section 44AD | Total sales or turnover exceeds Rs.2 crore |

| 3 | Carrying Profession and NOT using section 44ADA | Gross Receipt exceeds Rs.50 lakh |

| 4 | Carrying Profession and using section 44ADA | Claim income below the 50% of Gross Receipt. Further his income exceeds non-taxable threshold |

| 5 | Carrying Business and using section 44AD | Falls under section 44AD(4) and income exceeds non-taxable threshold. For clarity refer our previous article on Presumptive taxation. |

| 6 | Carrying Business and using section 44AE, 44BB, 44BBB | Claim income below the deemed income |

Meaning of Turnover or Sales for Tax Audit

Turnover shall exclude:

- GST or Service Tax

- Trade discount

- Goods returned

- Price Adjustment

- Cancellation of bill

- Composite charges like a good’s price include delivery charges

Turnover shall not exclude:

- Bad debt or its provision

- Royalty

A taxpayer has an option to either include or exclude excise duty from the turnover.

[Source: ICAI Guidelines- Tax Audit]

Tax Audit by a Chartered Accountant (CA)

A tax audit comprises of 2 components:

- Audit of Books of Account and

- Disclosure of prescribed Information by a Chartered Accountant only

Before commencing the tax audit, a CA should first choose the correct form for the audit.

There are 3 type of form for a tax audit. The selection of form depends on the circumstance of a taxpayer.

| Sl No | Taxpayer | To Be filled and signed by a Chartered Accountant (CA) in Practice | |

| Audit Report Form | Disclosure Form | ||

| 1 | If a taxpayer is required by any other law to get his accounts audited Example: Under Companies Act, every Company is required to have a statutory audit by a CA. | 3CA | 3CD |

| 2 | If the taxpayer is NOT required by any other law to get his accounts audited, the tax auditor should first conduct an audit of the books of accounts then file the prescribed forms. Example: A Proprietary Business | 3CB | 3CD |

Due Date or Last Date to File Tax Audit

Tax audit report should be filed up to 30th September of the assessment year.

For example Tax audit of the financial year, 2017-18 [AY 2018-19] should be filled on or before 30th September 2018.

In case of delay or non-compliance of section 44AB, a taxpayer shall be liable to pay a penalty @ 0.5% of turnover or gross receipt which may extend to Rs. 1.5 lakh [section 271B]. This penalty will be levied by the Assessing Officer at his discretion.

Recommended to Read: Fees for late filing of ITR under section 234F. [From AY 2018-19]

How to File Tax Audit Report

Follow the below steps to file tax audit report:

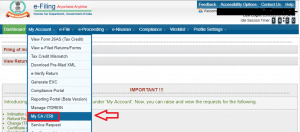

Step 1:

A Taxpayer should first add his chartered accountant on the income tax website using his own login credential.

Step 2:

After the 1st step, a chartered accountant is eligible to upload form 3CA/CB and 3CD through his CA Login credential.

Step 3:

After the CA’s upload, the taxpayer should check the correctness of the form (not mandatory) and after checking he can either accept or reject the CA’s submission. On acceptance, the process of tax audit comes to an end.

Note:

- Tax Audit report can’t be revised unless there is any change law with retrospective effect or change in the interpretation of the law or change in accounts after adoption at AGM.

- An Individual Chartered Accountant (CA) can accept up to 60 tax audit assignment. For example, a firm of 3 CA as a partner can accept up to a maximum of 180 tax audit assignment (60 x 3).

Happy Filing!

About Author

Pravin Giri

(@Pravin) Twitter | FacebookPravin is a Qualified Chartered Accountant [CA]. Gives opinions on Income tax, GST, and finance.Find him on Twitter @Pravinkumargiri

Popular topicsIncome tax Income from other sources Deduction Salary Personal Finance Senior citizen House Property Capital Gain TDS GST Companies Act GST FAQ TCS