Apart from the fixed salary, employers also provide various perks in form of either good, service or money to their employees such as a car, maid, a house without rent etc.

These perks are known as perquisites and it is completely taxable in the hands of the employees as Salary Income.

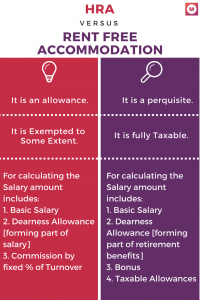

Rent free accommodation is completely different from the house rent allowance (HRA).

In this article, we will learn the taxation of rent-free accommodation perquisites and its calculation.

Type of Rent Free Accommodation

There are three type of accommodation which can be provided by an employer:

- Un-furnished

- Furnished

- Hotels

Tax is payable by the employees on the value of this accommodation if it is given to them for free.

Sometimes the employer charges nominal or concessional amount from the employee for this. Any money paid by the employee to the employer will reduce the tax liability on this perk.

Income tax law provides separate rule of taxation for government employees and non-government employees.

Tax on Rent free Accommodation given to a Government Employees

A person working as an employee of the following will be considered as a government employee:

- Central Government– Railway, Defences, Post Office

- State Government– Police, Govt. Teachers, doctors etc.

Employees of Banks, public sector company like NTPC, BHEL etc are not govt. employees.

Un-furnished Accommodation to Govt Employees

The license fee of such house will be considered as the value of rent-free accommodation (perquisites).

Example:

Mr. Satish is a Railway employee. The government has provided him a quarter (room) for his residence. Govt. don’t charge any rent from the employees. The fair rent of the quarter (room) is Rs. 8,400 per month and the licence fee is Rs. 3,000 per month.

In this case, the annual value of perquisite will be Rs. 36,000 [3000 x 12 months]. This Rs. 36000/- will be added into his salary income while filing the tax return.

Suppose If the government deduct Rs.2000/- per month as quarter rent from Mr.Satish’s salary than the excess of license fee over the deduction will be considered as the value of the perquisite i.e Rs.12,000 [(3000-2000) x 12]

Furnished Accommodation to Govt Employees

With the given formula we can find the value of this perquisites:

| Valuation of Rent free Furnished Accommodation | ||||

| Particulars | Amount | |||

| License fees | xx | |||

| Less: | ||||

| Rent paid employee | (xx) | |||

| Add: | ||||

| 10% of original cost of furniture of the employer or actual hire charges(if hired by the employer) | xx | |||

| Value of furnished accommodation | xxx | |||

Tax on Rent free Accommodation given to a Non-Government Employees

For calculating the value of perquisites of a non-govt employee, we need to consider the ownership status of the accommodation:

- Owned by the Employer, or

- Leased or Rented by the Employer

Perquisites Valuation when Accommodation Owned by the Employer

For Un-furnished house

| Value of Perquisites | If the city’s population as per 2001 census is |

| 7.5% of salary* | up to 10 lakh |

| 10% of salary* | more than 10 lakh but less than 25 lakh |

| 15% of salary* | more than 25 lakh |

For Furnished house

| Value of Perquisites | |||||

| 7.5%, 10% or 15% of salary* as the value of an unfurnished house [consider the city’s population] | xx | ||||

| Add: | |||||

| 10% of original cost of furniture of the employer or actual hire charges(if hired by the employer) | xx | ||||

| Value of furnished house (accommodation) | xxx | ||||

Perquisites Valuation when Accommodation Leased or Rented by the Employer

For Un-furnished house

Value of perquisite will be lower of:

- Rent paid or payable by the employer, or

- 15% of the Salary*

For Furnished house

| Value of Perquisites | |||||

| Lower of: 1. Rent paid or payable by the employer, or 2. 15% of salary* | xx | ||||

| Add: | |||||

| 10% of original cost of furniture of the employer or actual hire charges(if hired by the employer) | xx | ||||

| Value of furnished house (accommodation) | xxx | ||||

Salary*– Salary accrued (due) from all the employers during the accommodation period. This salary doesn’t include:

- Dearness allowance [if not taken for computing retirement benefits]

- Employer‘s contribution to provident fund

- Exempted allowances

- Perquisites

- Lump sum payments received on termination of employment or superannuation or voluntary retirement.

Tax on Free Hotel Accommodation

Valuation of free hotel accommodation (perquisites) is same for both govt and non-govt employees.

Value of perquisite will be lower of the following:

- 24% of salary paid or payable, or

- Actual charges paid or payable by the employer to such hotel

However, in case of transfer of employee the perquisite value of hotel accommodation will be exempted up to a maximum of 15 days.

Note:

You can calculate the value of this perquisite using a calculator provided by the tax department.

About Author

Pravin Giri

(@Pravin) Twitter | FacebookPravin is a Qualified Chartered Accountant [CA]. Gives opinions on Income tax, GST, and finance.Find him on Twitter @Pravinkumargiri

Popular topicsIncome tax Income from other sources Deduction Salary Personal Finance Senior citizen House Property Capital Gain TDS GST Companies Act GST FAQ TCS