In this article, we will discuss house rent allowance (HRA) deduction and its calculation for an employee. In General, this HRA forms part of the salary.

If HRA is not paid by the employer, an employee can still claim HRA exemption u/s 80GG.

What is House Rent Allowance (HRA)?

HRA is a compensation provided by an employer for rent paid for accommodation by an employee.

It is exempted in the hands of an employee to a certain extent only. [under section 10(13A) of Income Tax Act]. Any excess amount of HRA over the prescribed limit will be taxable.

There are various conditions to be fulfilled for availing HRA deduction. We will cover it one-by-one.

Person Eligible For HRA Deduction

The deduction of HRA is available only to a salaried individual who has the HRA component in his salary structure and is staying in a rented accommodation.

Self-employed professionals and employee not receiving HRA can avail this deduction under section 80GG.

HRA Calculation/Formula and Maximum Deduction

The Maximum HRA deduction shall be lower of the following (Rule 2A):

- HRA provided by the employer

- Rent paid less 10% of salary

- 50% of Salary if staying in Mumbai / Kolkata / Delhi / Chennai

- 40% of salary if staying in other cities

*Meaning of Salary: Basic+Dearness allowance (DA) forming part of salary as per the terms of employment +commission as % of turnover.

Salary accrued during the rental period shall only be taken. Salary received in arrear or advance shall be excluded.

Example: Mr. Shyam, having a monthly basic salary of Rs 20,000, receives HRA of Rs 8,000 and pays Rs 9,000 rent for a flat in Kolkata (metro city). Do HRA calculation for AY 2019-20

Solution: Maximum HRA deduction [exemption ] will be lower of the following amount (for a financial year):

i) Actual HRA received = Rs 96,000 (8k * 12)

ii) Rent paid less 10% of salary = [9000*12] less [20000*12*10%] = 108000 – 24000 = Rs.84000

iii) 50% of salary (metro city) = Rs 1,20,000 (50% of Rs 2,40,000)

Therefore,

| Exempted HRA For AY 2019-20 (lower of i, ii and iii above ) [under section 10(13A)] | 84000 |

| Taxable HRA | 12000 |

| HRA Received from Employer (8k*12) | 96000 |

You can also calculate using HRA calculator provided by Income tax department.

Documents Required for HRA deduction

For claiming HRA deduction, every employee should submit to the employer the following documents:

- Form 12BB [Application for claiming HRA]

- Rent receipts or rent agreement [leave and license agreement]

- If rent paid in a year exceeds Rs.1 lakh than PAN and address proof of landlord

In case of non-submission of these documents, the employer will deduct TDS on HRA portion also.

Situations where Deduction of HRA Not Available

- Assessee owns the accommodation in which he stays

- Assessee not paying rent for the accommodation in which he stays

- Assessee pays only up to 10% of his salary as rent

How to Claim HRA Exemption In ITR Form [AY 2018-19]

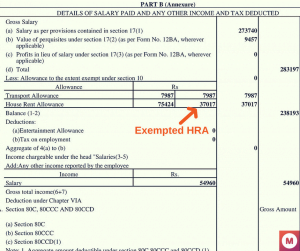

When the exempted HRA is deducted from the taxable salary income [ See part B of form 16]

Step #1: Disclose salary excluding all allowances [both exempted and taxable]

Step #2: Disclose the taxable HRA in “Allowances not Exempted“. Taxable HRA in the above form 16 is Rs. 38,407/- [75424-37017]

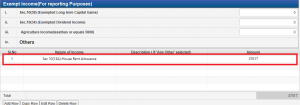

Step #3: Disclose the exempted HRA in tab “Taxes paid and Verification” of ITR 1

When the exempted HRA is NOT deducted from the taxable salary income

When an employee fails to supply the required document like rent agreement for HRA exemption, the employer report the whole of HRA allowance as taxable in form 16.

In this case, the employee can still claim HRA under section 10(13A) by deducting his salary to the extent of possible deduction.

In this case, there is a high chance of scrutiny by the Assessing officer. In case of tax notice for excess claim of HRA, submission of rent agreement can resolve the issue.

Relevant FAQ’s

Qes 1: I pay rent to my Parents. Can I get HRA exemption?

Ans: Yes, you can get HRA deduction of rent paid to the parents for accommodation. However, this rent amount will be taxable in the hands of your parents. Avoid sham transactions as it will cause trouble during scrutiny.

Qes 2: I live in a rented house with my spouse. Can we both claim HRA deduction?

Ans: Yes, both of you can get the deduction of HRA. The maximum deduction will be limited to the amount of rent each of you pays. Further, the rent agreement should include both husband and wife’s name.

Qes 3: I own a house in Patna but stays in Kolkata in a rented flat. Can I get HRA deduction?

Ans: Yes, you can get HRA deduction if it forms part of your salary. In case, your employer doesn’t provide HRA or you are not employed, exemption of HRA can be claimed under section 80GG. Simultaneously you can also take a tax deduction for payment of home loan instalment simultaneously. Read: Home Loan Interest Deduction

Qes 4: I stay in a rent-free flat provided by my employer. Can I get HRA deduction?

Ans: No, HRA cannot be claimed for any accommodation which is provided free of cost by an employer. Specific Documents are required for claiming HRA like rent agreement or rent receipts. Cost of these facilities forms part of your salary as perquisites.

Learn: The Calculation of Income of Let-out House

Happy Learning!

About Author

Pravin Giri

(@Pravin) Twitter | FacebookPravin is a Qualified Chartered Accountant [CA]. Gives opinions on Income tax, GST, and finance.Find him on Twitter @Pravinkumargiri

Popular topicsIncome tax Income from other sources Deduction Salary Personal Finance Senior citizen House Property Capital Gain TDS GST Companies Act GST FAQ TCS