In this article, we will cover the step by step process to file an online tax return for salaries and pensioner taxpayers in ITR 1 (Sahaj).

Who can File ITR 1 Sahaj

ITR 1 Sahaj is for a resident individual having

- Salary Income

- Pension income [Considered as salary]

- Income from one house property [not a case of brought forward loss or loss to be carried forward]

- Income from other sources (not being lottery winnings and income from race horses)

- Income taxable under section 115BBA [For foreign sports person]

- or income referred in section 115BBE

E-Filling of the tax return is mandatory for an individual whose taxable income exceed Rs.5,00,000.

Persons having income below Rs.5 lakh can file tax return in paper form also.

Who is not eligible to file ITR 1 Sahaj

Return Form ITR – 1 (SAHAJ) cannot be used by you if:

- You are a non-resident or not ordinarily resident.

- Your total income exceeds Rs. 50 lakh.

- You own 2 or more house property

- Earned income from lottery winnings or race horses or income taxable under section 115BBDA.

- Incurred gain or loss under the head “capital gain”

- Total income includes income under section 115BBE.

- Earned agricultural income of more than Rs. 5,000.

- Carry business or profession

- Incurred loss under the head “Income from other sources”

- You have claimed relief under section 90 and/or section 91.

- You have foreign assets (include share in a foreign company, bank account)

- You have earned income from outside India

- you have any income to be apportioned in accordance with provisions of section 5A

How to E-File ITR 1 for the financial year 2017-18 [AY 2018-19]

You can either file online or download offline ITR-1 and submit the xml (file format) on the website.

In the below process we will learn the process for filing online ITR 1:

Step #1:

Login to e-filling website with the credentials.

After login, you can either provide contact details of pop up or skip to step #2.

Step #2:

Go to e-File > Income Tax Return

Step #3:

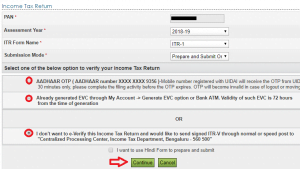

Put Assessment Year, Desired ITR Form name > Submission mode as “Prepare and Submit online” > Choose any of the verification option [a process which ensures that only legitimate person file return]

Step #4:

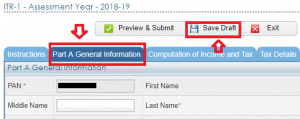

A general filing instruction is provided in the tab “Instruction”, take a brief look on that >

Fill all your general information in tab “Part A General information” especially the red * [after every 2-3 min press “Save Draft” to save the information]

Select your employer carefully

Select the section under which the return is filed:

- Choose 11: if the date of filing is on or before 31st July 2018

- Choose 12: If filed on or after 1st August 2018

Step #5:

Go to tab “Computation of Income and Tax” > Enter your salary income as mentioned in Part B (Annexure) of Form 16 and also enter any other income like house property, interest income etc.

Identify the taxable salary in part B of form 16:

[For clarity, see the last paragraph]

Step #6:

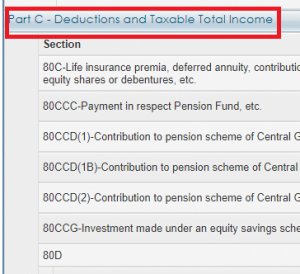

Disclose your deduction in part C like:

- Life Insurance premium + Child’s tuition fee + PPF etc : Section 80C

- Health Insurance Premium: Section 80D

- NPS contribution: Section 80CCD

Step #7:

In Part D you can fill tax relief of arrear or advance Salary [u/s 89] and rest other will get done automatically.

Recommended to Read: Computing Tax relief of arrear Salary

Step #8:

Go to tab “Tax Details” and Press “Refresh”, this will fill up the entire TDS deduction details automatically [match the details with your form 16 or 26AS]

Step #9:

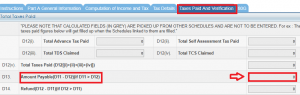

Go to tab “Taxes Paid and verification” > Disclose exempted income like agricultural income or LTCG gain, Exempted House Rent Allowances (HRA) > Disclose Bank account Details > put “Individual” in the filing capacity box > Location

Attention:

See the tax payable box :

- if it is zero then go further

- If there is any positive figure then pay the taxes first and go to step #8 to update payment

Step #10:

Go to tab “80G” > Enter the donation details

Recommended to Read: Deduction of Donation 80G

Final Step #11:

Press the green button “Press & Submit” > pop-up will follow if the information is incomplete

Again press button “Submit”

An acknowledgment will be available for download. Don’t forget to e-verify or send the signed ITR V (acknowledgement) to CPC, Banglore.

Here your return filing process will end.

How to fill Part B1 of ITR 1 for Salary Income

The below picture is of form 16 part B. Using this form we will understand the fill-up process of Part B1 of ITR 1.

Pay attention to the coloured boxes.

Except for the red box, enter the respective colour of the above form 16 in Part B-1 of ITR-1 (Sahaj)

Working for RED BOX:

| Working [Compare this with Part B of Form 16 ] | |||||

| Salary (excluding all allowances, Perquisites and Profit in lieu of Salary) | |||||

| (i))Salary as per provisions contained in section 17(1) | 273740 | ||||

| (ii) Salary from another employer | 54960 | ||||

| Total salary (including allowances) | 328700 | ||||

| Less: All allowances | |||||

| (i) Exempted Allowances (7987+37017) | -45004 | ||||

| (ii) Allowances not Exempted (75424-37017) | -38407 | ||||

| Total salary (excluding allowances) | 245289 | ||||

Exempted allowances should be disclosed in tab “taxes paid and verification” of ITR 1 form. [Refer step #9]

![]()

Happy Filing!

About Author

Pravin Giri

(@Pravin) Twitter | FacebookPravin is a Qualified Chartered Accountant [CA]. Gives opinions on Income tax, GST, and finance.Find him on Twitter @Pravinkumargiri

Popular topicsIncome tax Income from other sources Deduction Salary Personal Finance Senior citizen House Property Capital Gain TDS GST Companies Act GST FAQ TCS