During the financial year 2017-18, India’s largest bank SBI had earned Rs. 1,772 crores as a fee for non-maintenance of minimum balance in the bank account.

Many of us felt frustrated on this issue.

Reserve bank had directed the bank’s to provide no-frills account way back in Nov 2005 and subsequently amended it to BSBD account in FY 2012-13.

This RBI’s direction was the solution for the above problem.

To solve this, you don’t have to change the bank but you need to change the status of the Saving Account as ‘Basic Savings Bank Deposit Account’. [BSBDA]

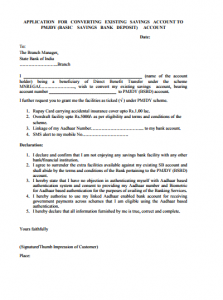

First, a new BSBDA account needs to be opened and once it is active you should close your old account within 30 days else the bank will close it.

Submit the below form in the home branch:

Who can open BSBDA Account

Who can open BSBDA Account

Any person whether being rich or poor can be open this account.

A person should make sure that he doesn’t have any other saving account in any other branches of that bank.

However, there is no restriction on opening Term/FD account, Recurring Account or any other account except a saving account.

Features of BSBDA Account

| Basic Saving Deposit Account | |

| Account Opening Charge | Zero |

| Minimum Balance | Zero |

| Maximum Deposit or Balance | Unlimited |

| Annual Maintenance Charge | Zero |

| Interest Rate | Same as any other saving Account |

| Add on Facility | ATM/Debit Cards (Banks may provide extra facilities) |

| Maximum Withdrawal Limit | 4 withdrawal per month |

| Account Closure Charge | Zero |

How to Open Online BSBDA Account in SBI

You can open BSBDA account in any other Indian and foreign Banks having a branch in India.

For State Bank of India (SBI), follow this:

Step #1: Visit SBI portal for BSBDA Account

[above link may not work]

Step #2: In bottom click on “Start Now” > “Fill New Customer Information Form”-

Fill up all the personal Details, PAN, Adhar Number (not mandatory) > Click “Proceed”

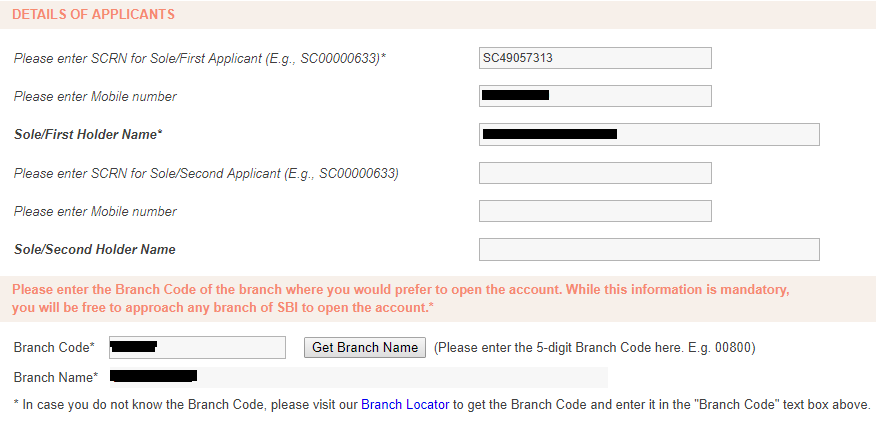

You will receive a 10 digit alpha-numeric SCRN number.

Step #3: A option to add another application is provided. You can select either of them. [I have selected no]

Click “Proceed”

Step #4: Enter SCRN no, preferred Branch code [you can open the account in any other branch also]

Select basic addon of ATM/Debit card and click “Proceed”

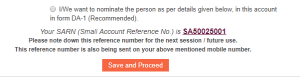

You will again receive a 10 digit alpha-numeric SAR number.

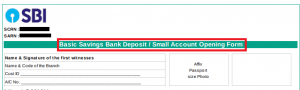

Step #5: Go to the website provided in step #1 and click on “Start Now” > Print Account opening Form > Enter your details

Take the print out of generated PDF in A4 size paper and fill up any necessary fields.

Step #6: Visit any SBI Branch with available KYC documents.

Bank’s branches also provide account opening form for this type of savings account.

Happy Saving!

About Author

Pravin Giri

(@Pravin) Twitter | FacebookPravin is a Qualified Chartered Accountant [CA]. Gives opinions on Income tax, GST, and finance.Find him on Twitter @Pravinkumargiri

Popular topicsIncome tax Income from other sources Deduction Salary Personal Finance Senior citizen House Property Capital Gain TDS GST Companies Act GST FAQ TCS