To avoid foreign tax deduction, every Indian citizen is required to submit tax resident certificate to their foreign tax authorities. [IRS for the USA]

Indian Citizenship is irrelevant for this certificate. A foreign national can also obtain this provided he fulfills the prescribed conditions.

In this article, we will cover various aspects of tax resident certificate and the process by which it can be generated.

Let’s save tax!

What is Tax Resident Certificate (TRC)?

This is a one of the necessary document which a person should have to avail tax relief under DTAA (Double Taxation Avoidance Agreements).

It is issued by the home country in which you are considered as a resident and is furnished to all the other foreign countries with which the home country has DTAA agreement.

In India, this certificate is issued by India’s Income tax authority to a person resident in India.

A person will be considered as a resident of India if:

- He stays in India for 182 days or more, or

- He stays in India for 60 days or more in the current financial year and also had stayed in India for 365 days or more in 4 preceding years.[For NRI, 60 days will be replaced with 180 days]

Example for point 2:

During the financial year 2017-18, Mr. Nitin a project Manager visits Singapore for 8 months and for remaining 4 months he stayed in India.

Even though he didn’t stay for 182 days or more in India, he will be an Indian resident for tax purpose if he had stayed in India for 365 days or more during the financial year 2016-17, 2015-16, 2014-15 and 2013-14. [4 preceding years]

This certificate can be used to either avoid TDS deduction by foreign tax authority or to claim the tax refund by filing tax return in the foreign country.

Type of Foreign Incomes on which DTAA applies

Here are the different types of foreign income on which DTAA applies:

- Interest on fixed deposits

- Interest on Saving bank account

- Capital gains earned in Foreign Country

- Salary received in Foreign Country

How to obtain India’s Tax Resident Certificate (TRC)? [Rule 21AB]

A complete manual process is followed in this case.

You may need to visit your Assessing officer’s (AO) office at least 2-3 times.

Step #1:

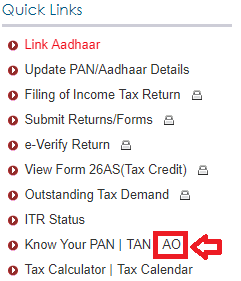

Locate your assessing officer online through the e-filling website by entering PAN and registered mobile number. [Left corner of the page under tab “Quick Link”]

Step #2:

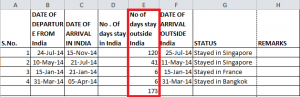

Make a document explaining your movement in and out of India through your stamped passport.

In case of electronic check-in or out through smart gates air ticket should be saved to explain the Assessing officer (AO). [Happens mostly in UAE]

Add up the days in the foreign land and disclose clearly your stays in Indian soil for the remaining number of days in a financial year.

Step #3:

Download Form 10FA and physically submit the filled up form with the assessing officer (AO).

Clearly, disclose the purpose of tax resident certificate. Example: To release the deducted tax amount from salary income earned abroad. [In point (x) of 2 in form 10FA]

Attach Xerox copy of the passport and mark all the stamps of arrival and departure as mentioned in step #2.

Final Step #4:

Assessing officer (AO) may ask you to visit his office to discuss the application.

AO’s satisfaction is must for obtaining Tax Resident Certificate (TRC).

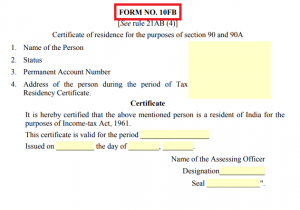

On being satisfied he will issue TRC in form 10FB.

Conclusion

Tax resident certificate help to avoid double taxation on an income.

For an Indian resident, his global income will be chargeable to tax and the foreign country will also charge tax on the income earned in that country but at a concessional tax rate as per the DTAA agreement.

About Author

Pravin Giri

(@Pravin) Twitter | FacebookPravin is a Qualified Chartered Accountant [CA]. Gives opinions on Income tax, GST, and finance.Find him on Twitter @Pravinkumargiri

Popular topicsIncome tax Income from other sources Deduction Salary Personal Finance Senior citizen House Property Capital Gain TDS GST Companies Act GST FAQ TCS